Richardson Isd Tax

For questions regarding this website please call Governmental Data Services at 817-431-6176. Richardson ISD 400 S.

Features (source:pinterest.com)

The adopted rate of 13909 per 100 property valuation is nearly 1 lower than the rate passed last year.

Richardson isd tax. Explore Explore All Programs North JH After School Pre-K xPlore Afterschool Programs Account Management Registration Quick Pay Account Management. Recreation Center Membership and Classes - This site allows you to purchase or renew memberships or enroll in. From 2019 to 2020 Richardson ISD added 858 million in taxable property values to the rolls.

Assist international tax team with reporting and filing of all international tax forms eg Forms 5471 8858 8865 TD-90-221 10421042s etc for over 200 foreign entities. Select Your Tax Office. The online self-service property tax solution to access your account balance payment history receipts and tax statements.

Garland Keene ISD0769600 Glenn Heights 0804430 Grand Prairieup to 118M will pay no franchise taxes. The Richardson ISD board of trustees adopted a slightly lower property tax rate at its Sept. Property Tax - This page provides contacts and other information on property taxes.

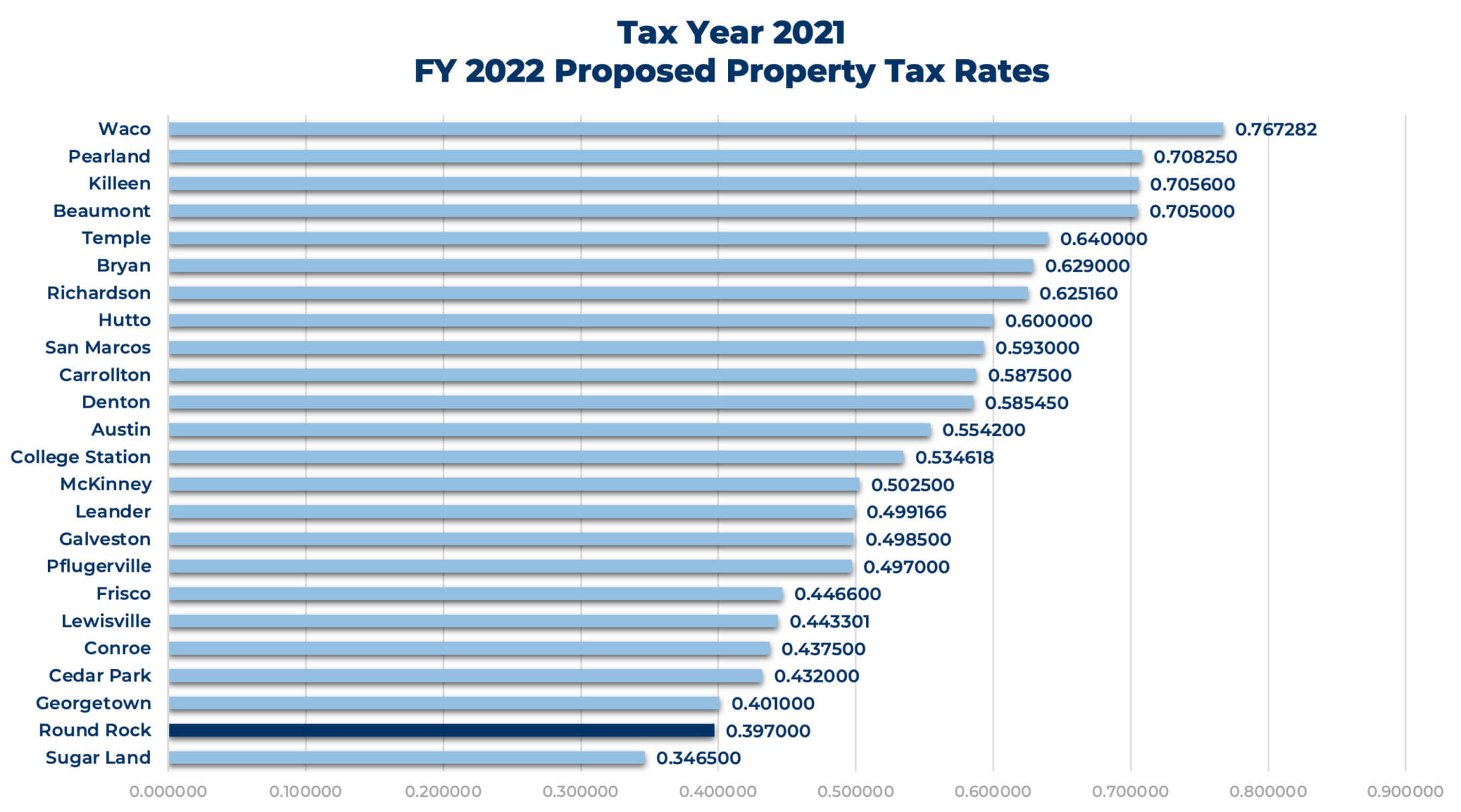

If the Richardson ISD measure passes residents would pay a total district property tax rate of 152 per 100 valuation. The Richardson ISD board of trustees adopted a slightly lower property tax rate at its Sept. The 0669998 Highland Park 0230000 Hutchins 0682459 Irving 0594100 Lancaster 0819736 Mesquite 0708620 Richardson 0625160 Rowlett 0745000 Sachse 0720000 Seagoville 0788800 Sunnyvale 0456700 University Park 0264750.

Box 830309 Richardson TX 75083-0309. 1002 AM on Aug 10 2021 CDT. 20 meeting that will generate more funds for the district than the 2020-21 rate.

Penn State University. Greenville Avenue Richardson TX 75081 School Districts Address City State ZIP Code Date. For tax questions please call your tax office - Richardson ISD Tax Office - 420 S.

Over 65 65th birthday 50000. Clicking on links embedded in this website may cause you to leave a web page maintained by Richardson ISD RISD. Melissa Richardson NATIONAL RETAIL ACCOUNT CUSTOMER SERVICE at.

Property Tax Online Payment Solution. For example according to DCAD RISDs property tax rate in 2019 was 141835 and was lowered to 14047 in 2020 but RISDs average property tax. For tax questions please call your tax office - Richardson ISD Tax Office - 420 S.

If your property is located in Collin County. Click here to begin. If your property is located in Dallas County.

Taxing units set their tax rates in August and September. After months of budget discussion and incorporating recommendations from the comprehensive community and staff strategic planning process that began last fall the Richardson ISD Board of Trustees voted to set the districts operating tax rate at 117 triggering a tax ratification election TRE that will occur on November 6 asking voters to approve an increased tax rate. The majority of revenue from RISD property taxes goes toward covering the districts maintenance and operations such as salaries and benefits.

Richardson ISD will temporarily offer virtual classes for students younger than 12 due to the increase in COVID-19 cases related to. 20 meeting that will generate more funds for the district than the 2020-21 rateThe adopted rate of 13909 per 100 property valuation is nearly 1 lower than the rate passed last year. Classroom Teacher at Mansfield ISD Mansfield TX.

2007 Exemptions and Property Tax Rates. The mission of the Los Angeles County Fire Department is to protect lives the environment and property by providing prompt skillful and. Richardson ISD 469 593-0797.

The tax rates are stated at a rate per 100 of assessed value. Property Tax is currently handled by County Tax Offices rather than the City of Richardson. The current rate is 139 per 100 valuation.

2020 Tax Rate Calculation Worksheet School Districts 2020 Richardson Independent School District School Districts Name 400 S. RISD is not responsible for the content privacy policies or accessibility of non-district sites. The Dallas County Tax Office Richardson Of Richardson Texas is located in Richardson currently provides 516 Twilight Trail in Richardson Texas and provides a full array of DMV services such as Road test Driving License Written CardsIdentification Cards Commercial License CDL Driving and CDL Written Test.

For a median homeowner in Richardson their school district property tax bill would increase about 240 to roughly 3750. Property taxes must be paid at the county tax office where your property is located. See reviews photos directions phone numbers and more for Richardson Isd Tax Office locations in Richardson TX.

With this new rate the average homeowner in Richardson will pay approximately 33 in school property taxes more per year than the last fiscal year according to.

Where Are Lowest Property Taxes In North Texas (source:pinterest.com)

Episd Board Of Trustees Adopt Tax Rate For 2021 22 (source:pinterest.com)

Key Issues Tax Expenditures Types Of Taxes Infographic Tax (source:pinterest.com)

Pin On Houses (source:pinterest.com)

Aggressive Road Building Program Requires Slight Tax Increase City Of Round Rock (source:pinterest.com)

Montgomery Isd Lowers Tax Rate Begins Planning For Possible May 2022 Bond Community Impact (source:pinterest.com)

17 Hollow Brook Rd Califon Nj Califon Patio Stones Stone Fire Pit (source:pinterest.com)

Komentar

Posting Komentar